No one likes to think about worst-case scenarios; we all imagine that we will live an accident-free life and our business will run smoothly until we retire. However, just as we buy insurance while hoping we never need it, we should look at our business operations and imagine what would happen if we suddenly became incapacitated by injury or illness or if you got hit by the proverbial bus. Who would notify your clients, pay your bills, and put your business on pause? Does that person know who your clients are or how to log into your email account?

No one likes to think about worst-case scenarios; we all imagine that we will live an accident-free life and our business will run smoothly until we retire. However, just as we buy insurance while hoping we never need it, we should look at our business operations and imagine what would happen if we suddenly became incapacitated by injury or illness or if you got hit by the proverbial bus. Who would notify your clients, pay your bills, and put your business on pause? Does that person know who your clients are or how to log into your email account?

In addition to estate planning, we solopreneurs need to plan for the unlikely situation in which someone who isn’t familiar with our needs to step into our shoes. The following are thoughts on how to write up instructions for where a family member, trusted friend or colleague could find everything needed to put your business on pause or, in the worst case, close it down for you.

Fill out this checklist (click here for an unannotated version) and give a copy to two people who might be called upon to help in an emergency, keeping in mind that a trusted colleague or good friend may be more familiar with your business – and the issues of a solopreneur in general – than a family member.

Scope creep, the phrase that strikes fear in the heart of every consultant…

Scope creep, the phrase that strikes fear in the heart of every consultant… I like to practice what I preach, and one of the ideas I have been thinking a lot about lately is being radically client-focused.

I like to practice what I preach, and one of the ideas I have been thinking a lot about lately is being radically client-focused. I don’t know about you, but I never found the Magic 8 Ball that would tell me what my clients value the most. Sure, I can make educated guesses. But what I have learned over time—and from talking with many coaching clients—is that generally we are way off when it comes to what our clients care the most about and are willing to pay us well for.

I don’t know about you, but I never found the Magic 8 Ball that would tell me what my clients value the most. Sure, I can make educated guesses. But what I have learned over time—and from talking with many coaching clients—is that generally we are way off when it comes to what our clients care the most about and are willing to pay us well for. One of the scariest things a solopreneur has to do is start the discussion of how much a project will cost. You might be having a great conversation with your client, in which you learn everything your client needs and you figure out how you can delight your client with your deliverable. Then comes the big moment where one of you has to start talking about cost….

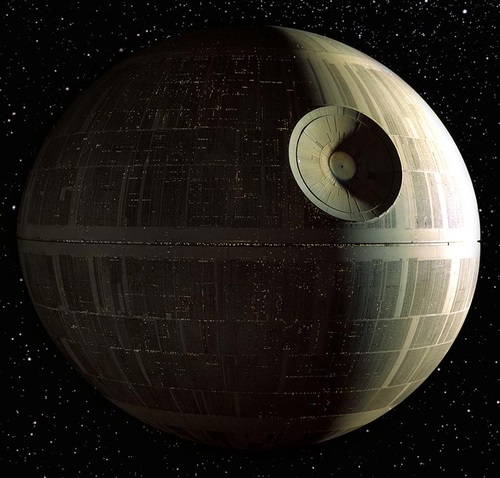

One of the scariest things a solopreneur has to do is start the discussion of how much a project will cost. You might be having a great conversation with your client, in which you learn everything your client needs and you figure out how you can delight your client with your deliverable. Then comes the big moment where one of you has to start talking about cost…. If you are a true Star Wars fan, you know who

If you are a true Star Wars fan, you know who